🔒Membership Positions - May 1, 2022

- Call to Leap

- Apr 30, 2022

- 9 min read

Hi wealth builders and new members!

We had a lot of earnings come out this week, followed by another sell-off. It seems like Wall Street is still resistant in putting their capital back into the markets, even with many companies delivering positive numbers.

Let's take a look at the overall markets:

Here's SPY:

Here's QQQ:

Here's DIA:

Technical Analysis 📈📉

SPY:

SPY dropped back down to the $411 level this week. If the sell-off persists, we could be revisiting the $404 level.

QQQ:

QQQ broke through the $317 level this week. The next level under may be the $297 level.

DIA:

DIA may revisit the $331 levels.

AMD:

AMD dropped back down to the $84 level this week and is still trending between the magenta support and resistance lines. We may be revisiting the $74 level if Wall Street does not like the numbers they report next week.

SBUX:

SBUX continued it's downward slide this week and we may be revisiting the $71 level.

WM:

On the bright side, WM made a new ATH this week, followed by some quick profit-taking. I may buy more shares if I see another $10 rise from here.

Trade of the Week:

Similar to last week, I don't recommend starting any new wheels since earnings are still being released and markets may be too volatile. I believe it may be more wise to observe how Wall Street reacts to these reports and if they serve as positive or negative catalysts, on top of news of looming interest rate hikes.

If you already have shares for your wheels, you can continue to sell 4-6 week calls against them to bring in cash, as I am also doing right now.

I am also starting new bear call spreads to pair with my covered calls. Stay tuned for the Premium Membership Post.

Ask Steve 💭

Let's see what some of our members asked this week. Here are the top questions we received:

Shubham

Q1. I bought 100 shares of few stocks and sold some covered calls, but wasn’t able to get out of my position on time.

Now I am stuck, what strategy would have been ideal? What mistake did I make?

The stocks are fundamentally good like AAPL, SBUX but I am not sure I made the right moves

eg. Bought stocks at 115 and now it is around lets say 80 cost basis around 110

I am looking for learnings and better understanding the situation . Thanks!

A: The market is currently experiencing a broad base sell off, and the majority of the stocks in the major indices have fallen due to macro-economic factors. I still like the fundamentals of these companies, but we may need to be a little more patient to see how markets react in the next couple of weeks. You can continue to sell further 6-week covered calls against the shares that you initially own to bring in more premium while we wait for the markets to calm down.

Alfredo

Q1. Hello, This might be a "dumb question", or pretty obvious... but just wanted to make sure that given how the stock market is currently, do we continue to invest monthly into long term stocks? And keep purchasing shares? For example, I bought 1 Microsoft share, 1 Costco, and 1 Waste Management this month. Next month do the same, and so on?

A: There's never a "dumb question", Alfredo. We are here to help! In short, it is completely up to you. We typically recommend slowly purchasing shares after the company you want to invest in delivers good earnings, positive guidance and as the price of the stock rises 5-10% from your last purchase price. We like to slowly scale into our positions. We don't like timing the market, but we do respect trends before investing. With current conditions, you can consider waiting for a trend reversal before investing again.

Karl

Q1. I was wondering if you could give me your opinion on a few stocks / investments that are not doing very well in my portfolio. in particular, I have 100 shares of AMD at $154 a share, 100 shares of SBUX at $115 a share and 100 shares of PINS at $55 a share. Is it a good long term strategy to sell them now and re-invest the proceeds into other stocks (i.e. VTI or SPY) or wait and hope that they bounce back over time? Thank you

A: Of course! Before we mention anything, we would like to say that whatever you do with your portfolio is completely up to you! Personally, we are still bullish on AMD for the long-term and we are just being patient. Their earnings are coming up soon so we'll see how they do and how it affects the stock. In regards to SBUX, we are waiting to see if they deliver good earnings. If they don't, we may consider exiting our positions by selling covered calls at or lower than our cost-basis, to slowly reduce our cost basis and ultimately have them get called away. For PINS, you can consider being patient for now as they have had 4 consecutive beats. However, taking the trend into consideration, it looks like Wall Street is not favoring this stock at the moment. If you do not want to own PINS anymore, you can consider still selling at your cost basis or even below, at a price you are comfortable letting your shares get called away for. You can consider selling at the delta 0.15 strikes around 4-6 weeks out.

Alex

Q1. Hello, I just put 6k into my Roth IRA. May I ask what I should specifically invest in? Thank you!

A: Great job, Alex! We like to be more conservative with our Roth IRA. Therefore, we put more weight on ETFs that track the S&P 500 like SPY or VOO. You can also consider investing in DIA, which tracks the DOW 30. You can also consider having a portion of fundamentally and technically strong stocks that are part of the S&P 500 and/or DOW 30 and pay a dividend. A few example are AAPL and MSFT. Remember that we recommend starting a small position, rather than using all of our investment capital at once.

Submit Your Questions 🙋♂️🙋♀️

Have any other questions? Before asking me and my team, feel free to check out our Level 1 FAQ. This FAQ is located on the Dashboard. You might find what you're looking for. 😊

If you do have questions, make sure to ask them on our Dashboard, rather than asking us via email. We also encourage you to watch all of the core video content and some of the past archived videos, read past Membership Positions, and take all the quizzes before sending us your questions.

Join Our Discord 💬

Investing, trading, and building wealth was a lonely journey for me. This is why my team and I created a Discord group for you and the other members to shares ideas and support one another. You don't have to go through it alone as we're all here to help. 😉

Make sure to check it out on the bottom of your "Dashboard" and follow the instructions on how to sign up. Coming from a teacher's perspective, I believe it's important to engage in conversations with people who are also seeking to reach financial freedom.

Remember that we are a community of wealth builders at all different levels, so be positive, kind, and helpful to others, so we can help each other get to financial freedom much faster.

Earnings Reports 📰

Many companies delivered their quarterly reports this week. To be responsible investors, it is important that we have an idea of how well the companies are doing in our portfolio and if they are increasing their revenue on a consistent basis. This will help ease our stress as it helps us better understand which companies are doing well in the midst of all these economic factors the markets are experiencing.

MSFT:

Quarterly revenue was $49.4B from $47.7B in the same period last year and increased 18%.

Quarterly revenue in Productivity and Business Processes (ex. Microsoft 365, LinkedIn) was $15.8B from $13.6B and increased 16%.

Quarterly revenue in Intelligent Cloud (Azure) was $19.0B from $15.1B and increased 26%.

Quarterly revenue in More Personal Computing (ex. Surface, Xbox) was $14.5B from $13.0B and increased 15%.

Microsoft's software-focused business model has also provided insulation from supply chain challenges that remain in a fluid state due to the evolving nature of COVID outbreaks and the Russia-Ukraine war.

Robust growth demonstrated across all business segments underscores Microsoft's steadfast leadership in the digitization era. The business continues to show no signs of buckling even under an increasingly clouded economic outlook.

AAPL:

Quarterly revenue was $97.3B from $89.6B and increased by 8.6%.

Quarterly revenue in iPhones was $50.6B from $47.9B and increased 5.6%.

Quarterly revenue in Macs was $10.4B from $9.1B and increased 14.3%.

Quarterly revenue in iPads was $7.6B from 7.8B and decreased 2.6%.

Quarterly revenue in Wearables, Home and Accessories was $8.8B from $7.8B and increased 12.8%.

Quarterly revenue in Services was $19.8B from $16.9B and increased 17.2%.

Apple authorized $90 billion in share buybacks and a 5% dividend increase.

CFO, Luca Maestri, warned of several challenges in the current quarter, including supply constraints related to Covid-19 that could hurt sales by between $4 billion and $8 billion. Apple also warned that demand in China could be affected by Covid-related lockdowns.

MA:

MA suspended business operations in Russia and the numbers reflect this below.

Quarterly revenue was $5.2B from $4.2B and increased by 24%.

Gross dollar volume was $1.9T and increased 17%.

Cross-border volume increased 53%.

Switched transactions increased 22%.

During the first quarter of 2022, Mastercard repurchased 6.8 million shares at a cost of $2.4 billion and paid $479 million in dividends. Quarter-to-date through April 25 the company repurchased 1.7 million shares at a cost of $599 million, which leaves $8.9 billion remaining under the approved share repurchase programs.

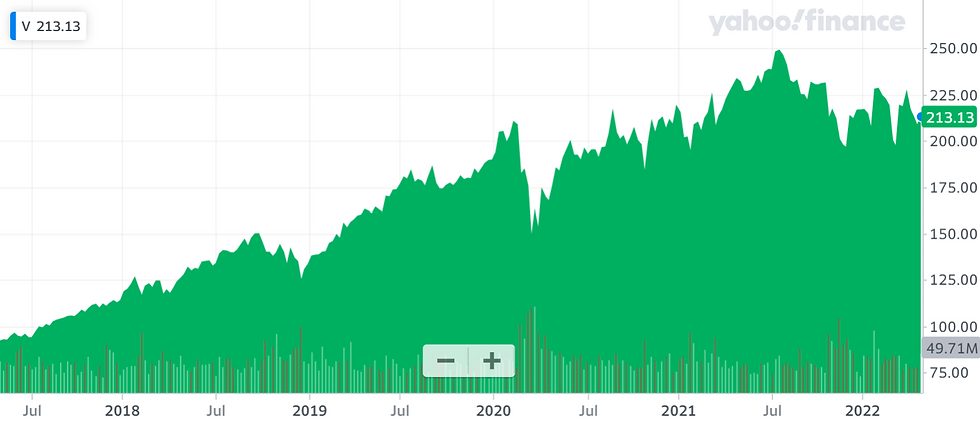

V:

Quarterly revenue was $7.2B and increased by 25%.

Quarterly revenue for services were $3.5B and increased 24% over the prior year.

Data processing revenues was also $3.5B and increased 16% over the prior year.

International transaction revenues was $2.2B and increased 48% over the prior year.

Total processed transactions, which represent transactions processed by Visa, were 44.8 billion, a 19% increase over the prior year.

Payments volume increased 17%.

Cross-Border Volume (Excluding Intra-Europe) increased 47%.

Cross-Border Volume Total increased 38%.

GOOGL:

Quarterly revenue was $68.0B from $55.3B and increased 23%.

Quarterly revenue in Google Search & Other was $39.6B from $31.9B and increased 24.1%.

Quarterly revenue in YouTube Ads was $6.8B from $6.0B and increased 13.3%.

Quarterly revenue in Google Network was $8.2B from $6.8B and increased 20.6%.

Total quarterly revenue for Google Advertising (Google Search & Other, YouTube Ads, and Google Network) was $54.7B from $44.7B and increased 22.4%.

Quarterly revenue in Google Cloud was $5.8B from $4.0B and increased 45%.

On April 20, 2022, the Board of Directors of Alphabet authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deemed in the best interest of the company and its stockholders, taking into account the economic cost and prevailing market conditions, including the relative trading prices and volumes of the Class A and Class C shares.

AMZN:

Quarterly revenue for total net sales (net product sales and net service sales) was $116.4B from $108.5B and increased 7.2%.

Net product sales revenue was $56.5B from $57.5B and decreased 1.7%.

Net service sales revenue was $60.0B from $51.0B and increased 17.6%.

AWS revenue was $18.4B from $13.5B and increased 36.3%.

Subscription services revenue was $8.4B from $7.6B and increased 10.5%.

Advertising services revenue $7.9B from $6.4B and increased 23.4%.

Physical stores revenue was $4.6B from $3.9B and increased 17.9%.

Amazon recorded a $7.6 billion loss on its Rivian investment after shares in the electric vehicle company lost more than half their value in the quarter. That resulted in a total net loss of $3.8 billion.

Revenue at Amazon increased 7.2% during the first quarter, compared with 44% expansion in the year-ago period. Institutional investors seem to be concerned with this slower rate of growth. This is slowest rate for any quarter since 2001 and the second straight period of single-digit growth.

Steve's Thoughts:

Looking through the numbers, I believe all of these companies are still strong and will stay resilient over the next 2-5 years. What amazes me the most are the companies who are dominating the cloud space and generating double-digit growth. Despite the rise in inflation, cloud services remain in high demand as corporate spending on digital transformation continue to rise.

Remember that many businesses are in the digital space and will require external cloud services to facilitate with online security, computing, and data storage. Companies like Netflix and Facebook, and an abundance of online retail stores use Amazon Web Services (AWS). I even remember that the schools that I've taught at used AWS and the Google Cloud Platform (GCP) for emailing and file storage. And if we think even deeper, once we are accustomed to a particular service and their ecosystem, it is difficult for us to leave and easier for these businesses to charge higher prices later on, which in turn makes it easier for them to generate even higher top line revenue.

Since we're in a volatile market with uncertainty of the next moves by the Federal Reserve and still waiting for the last batch of earnings to come out over the next couple of weeks, I would invest cautiously. To be more on the conservative side, I would even wait for this downward trend to reverse and the sentiment in the markets to turn positive before slowly scaling into my positions.

I understand that it's a rough time in the markets for all of us right now, even with all these companies delivering spectacular numbers. However, I encourage you to be forward-looking. Despite the sell-offs we've been observing over the past few weeks/months, it is important to ask ourselves where we believe these companies will be in the next 2-5 years, rather than the next 2-5 months.

Right now, I believe it's strategic to stay with steady companies like AAPL and MSFT, that have been around for many years and weathered through many storms. We want to stay with companies with large moats, have the ability to pay dividends, and are part of the major indices (S&P500 and DOW30).

Stay strong and patient, everyone. We are in this together! 💪

-Steve and the Call to Leap Team

The following article is strictly the opinion of the author and is to not be considered financial/investment advice. Call to Leap LLC and the author of this article does not claim to be a registered financial advisor (RIA) or financial advisor. Please visit our terms of service and privacy policy before reading this article.