🔒 Membership Positions - September 5, 2021

- Call to Leap

- Sep 4, 2021

- 14 min read

Updated: Sep 8, 2021

Hey Everyone!

Looks like we trended a little sideways this week. There wasn't much excitement that went on since Wall Street is most likely taking a little break.

Here's SPY:

Here's QQQ:

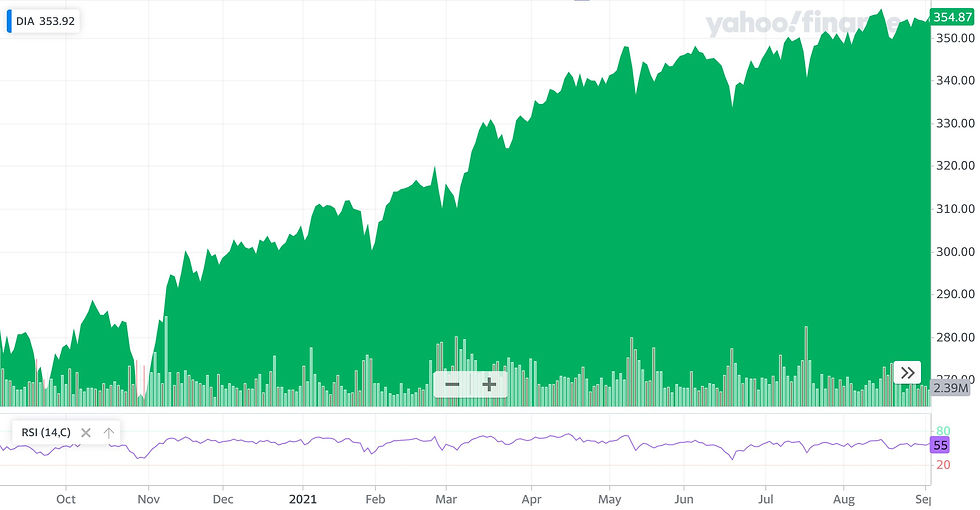

Here's DIA:

Trade of the Week:

Spinning your wheels: If your covered calls expired worthless this Friday, we recommend selling more calls at around the same strike price as before to collect more premium. If you sold some cash-secured puts and they lost around 80% of their value, you can consider buying back the contracts and reselling them for a further date to collect more premium. If your shares were called away last week, you can consider restarting your wheel. For beginners, you can consider starting again by selling a cash-secured put, around 1-3 strikes OTM (or for a lower price).

Pay attention to the delta: You can always look at the delta of the call you are selling since the delta roughly approximates the probability of the price of the stock reaching the strike by expiration. If you see that the delta is 0.10, you know that there is roughly a 10% chance that the price of the stock will reach that strike price by expiration. Likewise, if you see that the delta is 0.20, you know that there is roughly a 20% chance that the price of the stock will reach that strike price by expiration.

Keep It Balanced: I know we are in a bullish market, but I still want to give you a friendly reminder to not go overboard with growth stocks, like AMD and PINS, for your Wheels. Yes, they do have high premiums and they are relatively less expensive compared to AAPL, NKE, SBUX, and MSFT. However, just keep in mind that stocks that don't pay a dividend and have high premiums/IV typically drop the fastest when there is uncertainty in the markets. If you are brand new to starting the Wheel, we recommend starting off with AAPL, NKE, SBUX, or MSFT.

Here are some trade recommendations and see what fits your personal risk-tolerance:

MSFT Monday Open: $301.12 Friday Close: $301.14 5-day change: 0%

Starting a New Wheel: Selling a Cash-Secured Put on MSFT - MSFT's Current Price: $301.14 - Capital Needed: $30000.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $300 - Premium you'll receive: $388.00 - Cost Basis: $300.00 - $3.88 = $296.12

Starting a New Wheel: Selling a Covered Call on MSFT - MSFT's Current Price: $301.14 - Capital Needed: $30114.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $305 - Premium you'll receive: $645.00 - Cost Basis: $301.14 - $6.45 = $294.69

AAPL Monday Open: $149.00 Friday Close: $154.30 5-day change: 3.55%

Starting a New Wheel: Selling a Cash-Secured Put on AAPL - AAPL's Current Price: $154.30 - Capital Needed: $15000.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $150 - Premium you'll receive: $154.00 - Cost Basis: $150.00 - $1.54 = $148.46

Starting a New Wheel: Selling a Covered Call on AAPL - AAPL's Current Price: $154.30 - Capital Needed: $15430 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $155 - Premium you'll receive: $347.00 - Cost Basis: $154.30 - $3.47 = $150.83

AMD Monday Open: $112.61 Friday Close: $109.92 5-day change: -2.38%

Starting a New Wheel: Selling a Cash-Secured Put on AMD - AMD's Current Price: $109.92 - Capital Needed: $10900.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $109 - Premium you'll receive: $313.00 - Cost Basis: $109.00 - $3.13 = $105.87

Starting a New Wheel: Selling a Covered Call on AMD - AMD's Current Price: $109.92 - Capital Needed: $10992.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $110 - Premium you'll receive: $360.00 - Cost Basis: $109.92 - $3.60 = $106.32

NKE Monday Open: $167.89 Friday Close: $163.29 5-day change: -2.73%

Starting a New Wheel: Selling a Cash-Secured Put on NKE - NKE's Current Price: $163.29 - Capital Needed: $16000.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $160 - Premium you'll receive: $393.00 - Cost Basis: $160.00 - $3.93 = $156.07

Starting a New Wheel: Selling a Covered Call on NKE - NKE's Current Price: $163.29 - Capital Needed: $16329.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $165 - Premium you'll receive: $458.00 - Cost Basis: $163.29 - $4.58 = $158.71

PINS Monday Open: $56.81 Friday Close: $56.59 5-day change: -0.38%

Starting a New Wheel: Selling a Cash-Secured Put on PINS - PINS's Current Price: $56.59 - Capital Needed: $5600.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $56 - Premium you'll receive: $172.00 - Cost Basis: $56.00 - $1.72 = $54.28

Starting a New Wheel: Selling a Covered Call on PINS - PINS's Current Price: $56.59 - Capital Needed: $5659.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $57 - Premium you'll receive: $222 - Cost Basis: $56.59 - $2.22 = $54.37

SBUX Monday Open: $115.61 Friday Close: $117.19 5-day change: 1.36%

Starting a New Wheel: Selling a Cash-Secured Put on SBUX - SBUX's Current Price: $117.19 - Capital Needed: $11700.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $117 - Premium you'll receive: $176.00 - Cost Basis: $117.00 - $1.76 = $115.24

Starting a New Wheel: Selling a Covered Call on SBUX - SBUX's Current Price: $117.19 - Capital Needed: $11719.00 - Sell at the Expiration Date: 2021-09-24 - Select the Strike: $118 - Premium you'll receive: $227.00 - Cost Basis: $117.19 - $2.27 = $114.92

Ask Steve 💭

Let's see what some of our members asked this week. Here are the top questions we received:

Glenn

Q1: Hello! I am currently going through Level 1 Videos and a lot of reference is made to intrinsic and extrinsic value. Would it be possible to define what these terms mean in layman's terms?

A1: Extrinsic value is the difference between the market price of an option, also known as its premium, and its intrinsic price, which is the difference between an option's strike price and the underlying asset's price. Since you are a beginner and only selling options, you don't need to worry too much about this. When you graduate yourself to Level 2 and 3, you will then need to understand intrinsic and extrinsic values more.

Q2: Why would selling a put OTM reduce the likelihood of assignment during a downward trend as opposed to a put ATM or ITM ? If the price drops below the strike price (which is more probable during a downward trend), wouldn't you need to buy the shares ? Wouldn't selling the put ITM reduce the likelihood of assignment, since the strike price is higher?

A2: When selling cash secured puts, we typically avoid selling them during bear markets because we don't know where the stock is going to stabilize. Selling a cash secured put OTM reduces the likelihood of assignment because it gives the stock more room to drop without being assigned. Let's say a stock is currently trading at $100. If you sell a CSP at $99 (OTM), you are only giving yourself a $1 cushion if the stock drops, not protecting you from a bigger drop. If you sell a CSP at $95 for example, you're giving yourself some more cushion if the stock pulls back a few dollars by the time of expiration. A $5 buffer is more than a $1 buffer, hence, you give yourself more "protection" when you sell more OTM (below the current stock price) therefore reducing the likelihood of you being assigned the shares at expiration. If you sold ATM or ITM, you would be paying more for the shares if the stock drops. For example, if a stock is trading at $100 and you sell a CSP at $101 and the stock drops to $95, you'll be obligated to buy at $101 as opposed to selling a CSP a few strikes OTM at lets say $97. Being assigned at $97 would be better than being assigned at $101.

Q3: Hello! Would it be best to invest in ETFs or in individual stocks for the long term?

A3: Great question! You can consider doing a little both and invest in fundamentally strong stocks and ETFs that track the S&P 500 for the long-term. The difference is that when you're investing in fundamentally strong stocks, you're investing in individual companies as opposed to ETFs where you're essentially investing in a "basket" of stocks. Since you are a beginner, we recommend starting off with a small position size and just buying 1-5 shares of some ETFs and stocks.

Page

Q: Hi I’ve been reading the faq and the the questions in the membership positions and have seen the idea of ‘cancelling a contract’ come up a few times. I’m not sure if I understand the concept. When would I want to cancel a contract? How would I go about doing so? What, if any, ramifications are there to the trade when cancelling a contract? Thanks.

A: Great question! You can consider cancelling a contract or "buying back a contract" you sold when you've received around 90-95% of your premium. The reason for this is because if you sell a 4 week expiration contract for $300 premium and your option becomes "cheap" to buy back after 2 weeks (costs $30 to buy back (You've received 90% of your premium already)), it wouldn't be effective to wait another 2 weeks for your option to expire to only make $30. You can instead consider buying it back for $30, locking in a $270 profit from your premium and selling another option 4 weeks out for another $300, therefore giving you more premium. Another reason you would cancel/buy back a contract would be to "buy back and roll out". Please watch our "buying back and rolling out" video in our level 1 section under tutorials for a more in depth explanation.

Said simply, you buy back the contract for a higher price than what you received as premium, but then immediately sell it for an even higher price, with a further expiration date. A ramification would occur if you pay more than what you received as premium to cancel/buy back your contract. This is assuming you don't sell it back for a higher price. This would be a loss because you're simply paying more than what you received as premium to cancel/buy back a contract. Because this is more of a complex concept, consider letting your options expire until you get the hang of this strategy.

Buddy

Q: First, my friend recommended this course and it has been very helpful, but I have a kind of special (at least to me) situation I would like to get advised on. I am 65 yrs old and plan on retiring in 6-8 months. I don’t have a lot of 401K money to deal with and only around $30k that I will be able to use for covered calls and investing. To be honest, I am counting on the covered calls as an extra source of income in my retirement and did not plan on using a lot for long term investments. Thanks.

A: We are very happy to hear that you've found value in our community and we're excited to be a part of your financial journey, going into retirement. You can consider using the wheel strategy to earn monthly income. Please keep in mind that if stock prices rise, it will cost more to enter wheels, therefore limiting your ability to trade the wheel, long-term. This is why we recommend contributing to your brokerage account each month in addition to reinvesting your premiums into long-term stocks to grow your wealth over time. In addition, we recommend that you have an emergency fund that will cover all of your expenses for at least a few months due to the possibility of a correction. Due to the market being unpredictable, monthly premiums may vary. Since you may want to be more on the conservative side of trading, you may want to consider only trading stocks that are part of the DOW30 and pays a dividend. At the end of the day, what you do with your portfolio is completely up to you.

Khan

Q: Hi. I was assigned to a stock long before my stock expires (sold a CSP). Why did that happen?

A: When we sell contracts, the person on "the other side" can exercise their contract whenever they would like to. Although the majority of contracts typically go to expiration, there are times when the person on the other side decides to exercise their contract. When this happens, your shares are either called away (If you're selling a covered call) or you are obligated to purchase the shares at the agreed strike price (When selling a cash-secured put). For example, the person on the other side may exercise their contract to obtain shares before the ex-dividend date to be eligible for the dividends on the stocks.

Page

Q1: I am looking to start a wheel with AMD. Two, actually. I was thinking of buying 100 shared outright to sell a covered call and then also selling a put for another 100 shares. Are there any considerations I should make when doing trades like this? Or in particular with AMD?

A1: When trading AMD, keep your risk tolerance and the volatility of AMD in mind. You can consider splitting up your wheels if you have the capital to do so. For example, one AMD wheel and one AAPL wheel. This way, you'll have a volatile wheel and a "more stable" one. With that being said you can do whatever you like with your portfolio. If you want to do two wheels, consider selling them one week apart so that you can get in on different times of the market. For example, you can consider selling one CSP or CC on Monday and then another CSP or CC the following Monday. You can also consider selling a CC and CSP on the same day if that is what you would like to do. At the end of the day it's really up to you.

Q2: I know AMD is a more volatile stock than the others. I noticed in the membership positions that the strike prices are still relatively close to their current price at time of contract. If the stock is more volatile then why wouldn’t I want to select a strike that is further out?

A2: The prices we have in our membership positions are trades you can consider. You are always welcomed to play with the numbers according to your risk tolerance, strategy, etc. It all depends on what you're trying to do. Let's take a CSP for example. If the underlying stock price is $100 and you want to be more conservative when selling a CSP to not take on the responsibility of purchasing the 100 shares, you can consider selling at the $97 strike. The more OTM you go when selling CSPs, the more "protection" you have if the stock drops. For example, the $95 strike would give a $5 buffer as opposed to the $97 strike that would give a $3 buffer. In contrast, when selling a CC, if you want to decrease the chance of your shares getting called away, you can consider selling more OTM. Consider looking at the delta to see what the percentage is for the stock reaching that price by expiration. Keep in mind that your premiums are typically less when you sell more OTM.

Q3: I think we all know that this bull market is due for something to happen, whether it be a correction or what. If I have a covered call or put contract already sold and the price of the stock drops drastically, I would lose my shares at a very low price, or purchase shares at a much higher price than its currently trading at. Therefore I would lose a lot of money. Is there any advice for downside protection? Would cancelling the contracts protect me at all? Or should I just only work a small portion of my portfolio?

A3: When we utilize the Wheel Strategy, we make sure the stocks we trade are stocks we don't mind holding on for the long-term anyway. With that being said, if/when a correction happens, we become patient and wait for our shares to retrace. If you sell a covered call and the underlying stock price drops below your strike price at expiration, your contract would expire worthless and you'll keep the premium and your shares. If you sell a CSP and the underlying stock price goes below your strike price at expiration you are obligated to purchase those 100 shares.

When selling CCs and CSPs, you would only lose money if you sell shares for less than what you purchased them for. For example, if you were assigned shares from a CSP at $100 for a stock and it goes down to $80, this is an unrealized loss of $20. If you sell at $80 then you would lock in a $20 loss. However, if you wait it out and be patient, the stock can retrace again up over $100 for an unrealized gain.

Now let's look at a CC. If you buy 100 shares at $100 and sell a covered call at $101 and the underlying stock drops to $80 you again have an unrealized loss of $20. If you sell your shares at $80, you lock in that $20 loss. Again, if you're patient and the stock rises above $100, you'll then have an unrealized gain which you can then lock in for profit.

When selling a CSP, you can consider selling a few strikes below (OTM) the underlying stock price to be more conservative. Please note that as you sell more OTM, the premiums decrease.

Submit Your Questions 🙋♂️🙋♀️

Have any other questions? Before asking me and my team, feel free to check out our Level 1 FAQ. This FAQ is located on the Level 1 page. You might find what you're looking for. 😊

If you do have questions, make sure to ask them on our Dashboard, rather than asking us via email. We also encourage you to watch all of the core video content and some of the past archived videos, read past Membership Positions, and take all the quizzes before sending us your questions.

Technical Analysis 📈📉

It's the beginning of September. Did you pay yourself already and deposit your goal amount into your brokerage account?

Remember that as you are on your journey to financial freedom, you'll want to slowly and comfortably increase the amount you are depositing each month, so your money can compound faster.

Some of you are depositing $500 to start and increasing it by $50 each month. So perhaps you may deposit $550 the next month, $600 the following month, and $650 the month after.

Am I still investing and building my wealth? You bet I am!

Here are some of the stocks I'm still slowly adding to my portfolio.

V:

MA:

It looks like V and MA have been selling off recently. If you are new to investing, you may want to wait until we see a little retracement before purchasing more shares. If the stock rises around 5%, it may give us the signal that institutional buying is coming back and we can ride the wave up with them.

If you're a more seasoned investor, you can consider buying a couple of shares since you're risk tolerance is most likely higher and you've been investing in these stocks for a couple of years already.

PYPL:

SQ:

With these 4 digital payment stocks, they typically do well in the fourth quarter since consumer spending is highest during this time (ex. Black Friday, Christmas, etc.). Some institutions like to buy more of these shares to get ahead of earnings. I recommend keeping an eye on these stocks for the next 4-6 weeks.

HD:

EL:

DIS:

And of course, I'm also adding a couple more ETFs, like QQQ and SPY, just to mix things up.

Stop Looking At Your Account So Much! 👀

Let's be real here. A lot of us are guilty with looking at our accounts every day. We panic whenever we see a little pullback and we get extremely excited when we see our favorite investments move up $5.

I encourage you to practice being patient and to not have your eyes glued to your screens all day long. If you are someone who has been investing and trading for less than a year, this will most likely drive you insane.

I do not want to see your emotional well-being tied to the "account number" that you see. Remember that these numbers are often unrealized gains or losses, which don't really mean anything. What are actually realized are the premiums you collect each month from selling covered calls and cash-secured puts.

Here's a picture of the S&P500 over the past 5 years. Go ahead and soak it in.

Notice that with every valley, there is always a new peak that follows?

Always keep your eyes on the long-term trend! People with this type of patience and discipline are the successful ones with building wealth over the long-term. 👌

Join Our Discord 💬

Investing, trading, and building wealth was a lonely journey for me. This is why my team and I created a Discord group for you and the other members to shares ideas and support one another. You don't have to go through it alone as we're all here to help. 😉

Make sure to check it out on the bottom of your "Dashboard" and follow the instructions on how to sign up. Coming from a teacher's perspective, I believe it's important to engage in conversations with people who are also seeking to reach financial freedom.

Remember that we are a community of wealth builders at all different levels, so be positive, kind, and helpful to others, so we can help each other get to financial freedom much faster.

Alright everyone. Remember that we are heading into Labor Day and 9/11, which is typically a slower period.

Stay patient and have a wonderful Labor Day weekend! 🙂

-Steve and the Call to Leap Team

The following article is strictly the opinion of the author and is to not be considered financial/investment advice. Call to Leap LLC and the author of this article does not claim to be a registered financial advisor (RIA) or financial advisor. Please visit our terms of service and privacy policy before reading this article.